What is Carbon Pricing?

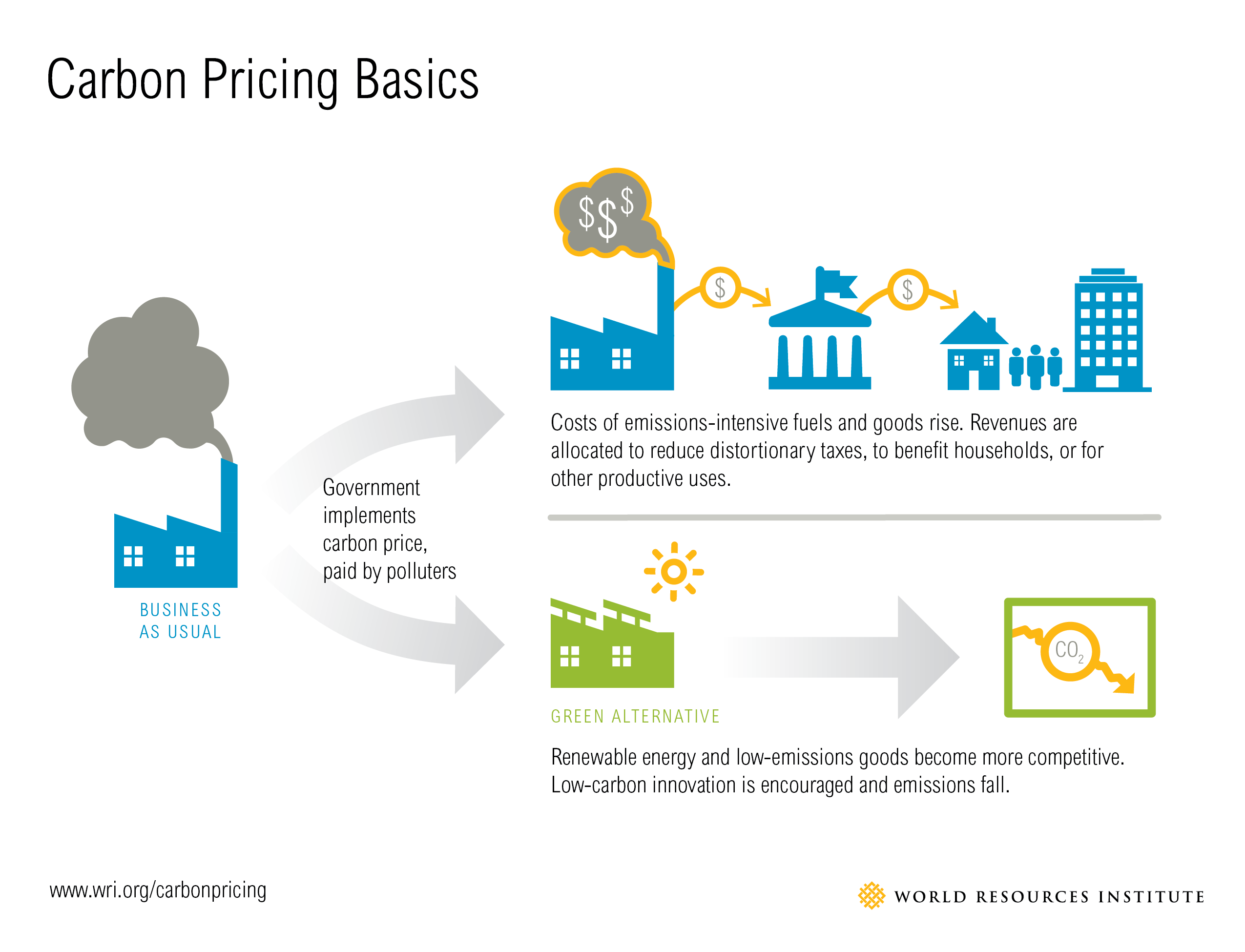

Carbon pricing is a mechanism to reduce atmospheric concentrations of Greenhouse Gases by imposing a price on the emitters of carbon or by encouraging the emitters to reduce their emissions.

Under this mechanism, the GHG producers must pay for the climate change induced destruction instead of the public. The producers have the option of continuing to emit and pay high prices or avoid paying high prices by reducing their emissions by investing in cleaner technologies.

Need

- Carbon pricing is an important mechanism which can help to fulfil the goals of the Paris Agreement, which aims to combat climate change by limiting the global temperature rise to 1.5 Degrees Celsius above pre-industrial levels.

- It can help in the fulfilment of Sustainable Development Goals(SDGs).

- It can generate revenue which can be used in the green economy for Research and Development into clean technologies, enabling vulnerable communities to adapt to climate change impacts, etc.

Process

Some of the carbon pricing instruments include Emission Trading System (ETS), Emission Reduction Fund and the Carbon Tax.

Emission Trading System (ETS)

Emission Trading systems, also called cap and trade systems, is a system within which allowances/permits to emit Greenhouse Gases (GHGs) are traded between the emitters of these gases.

Working of ETS

- An environmental goal, i.e., a limit on the amount of GHGs/pollutants to be emitted, is first established.

- Sources covered under the ETS receive an allowance, which allows them to emit one tonne of the GHGs/pollutants into the atmosphere.

- It is entirely the choice of the sources whether they want to use the allowance for compliance, trade it in the allowance market, etc.

- The sources can reduce their emissions much below the limit to save their extra allowances and sell them in the allowance market.

- Sources must monitor their emissions of pollutants or GHGs through continuous emissions monitoring systems and report this data to the concerned agency.

- The concerned agency can make data available to the public by releasing annual progress reports regarding emissions and compliance.

- The sources are penalised if they don’t possess enough allowances to justify their emissions.

Emission Reduction Funds

Emission Reduction Funds is a scheme funded by taxpayers in which the government purchases credits earned by emission reduction projects.

Carbon Tax

A carbon tax is a tax which is imposed on usage of fossil fuels which aims to promote the usage of cleaner sources of energy and move away from fossil fuels.

Hybrid approach

A hybrid approach combines both Emissions Trading System (ETS) and Carbon Tax, can also be adopted to satisfy the special needs of a jurisdiction.

Resource pages: